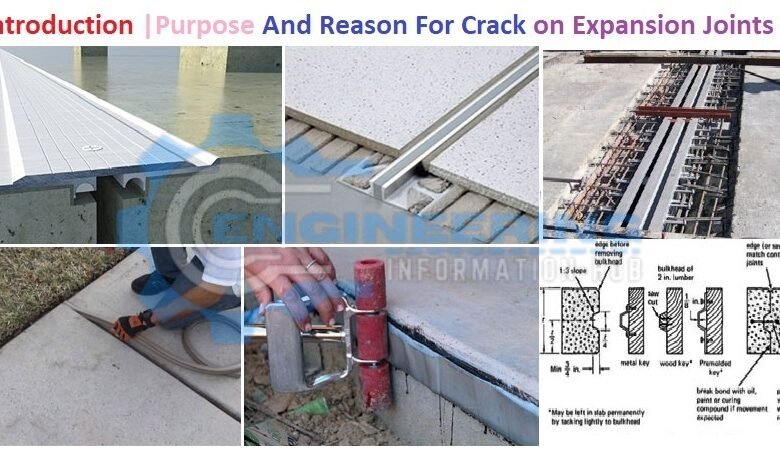

Introduction |Purpose And Reason For Crack on Expansion Joints

Introduction of Expansion Joint |Possible Reason For Crack on Expansion Joints |How To Install The Expansion Joint |Purpose of Expansion Joints |Types of Expansion Joints |Characteristics of Expansion Joints |

Introduction |Purpose And Reason For Crack on Expansion Joints

Cracks in concrete may do at the expansion joints due to improper concrete blend or curing. These conditions beget loss between the expansion joints and cracks can be formed. Expansion joints are placed in concrete to help extensive cracks formed due to temperature change. Introduction |Purpose And Reason For Crack on Expansion Joints.Introduction |Purpose And Reason For Crack on Expansion Joints Introduction of Expansion Joint |Possible Reason For Crack on Expansion Joints |How To Install The Expansion Joint |Purpose of Expansion Joints |Types of Expansion Joints |Characteristics of Expansion Joints |

Definition of Expansion Joint

Expansion joints are placed in concrete to help extensive cracks formed due to temperature change. Concrete will procedure crack when the temperature will change or hight. Expansion joints are handed in crossbeams, pavements, structures, islands, sidewalks, road tracks, pipeline systems, vessels, and other structures. This composition stresses the need for expansion joints in concrete, characteristics of expansion joints, types of expansion joints, and installation of expansion joints. Cracks developed due to the expansion of concrete.

Purpose of Expansion Joints

common in Concrete Concrete isn’t an elastic substance, and thus it doesn’t bend or stretch without failure. still, concrete moves during expansion and loss, due to which the structural rudiments shift slightly. To help dangerous goods due to concrete movement, several expansion joints are incorporated into concrete construction, including foundations, walls, roof expansion joints, and paving crossbeams. These joints need to be precisely designed, located, and installed. However, an expansion joint will be necessary to reduce stresses, If an arbor is deposited continuously on shells exceeding one face. Concrete sealer may be used for the stuffing of gaps produced by cracks.

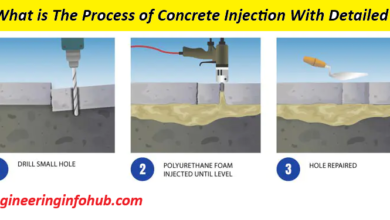

Definition |Procedure |Materials And Types of Grouting With Details

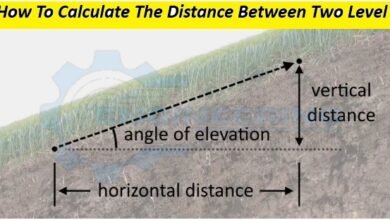

How To Calculate The Main Bar And Distribution Bar

Why Using The Crank Bar In Slab Column RCC Beam

Characteristics of Expansion Joints

Expansion joints permit thermal compression and expansion without converting stresses into rudiments.

An expansion joint is designed to absorb safely the expansion and compression of several construction accoutrements, absorb climate, and permit soil movements due to earthquakes or ground agreement.

Expansion joints are used in between two portions of concrete like paving cross beams road tracks and pipelines etc.

Expansion joints will react to the stresses of concrete An expansion joint is simply a disposition between parts of the same accouterments.

The expansion joints are expressed as control joints in the concrete block construction.

Types of Expansion Joints

Common Grounded on the position of the joint, expansion joints are divided into the following types,

-

Bridge Expansion Joint

-

Masonry Expansion Joint

-

Road Expansion Joints

-

Pipe Expansion Joints

Bridge expansion joints

Bridge expansion joints are designed to allow for nonstop business between structures while accommodating movement, loss, and temperature variations on corroborated and prestressed concrete, compound, and sword structures.

Masonry Expansion Joint

Masonry Expansion Joint Clay bricks expand as they absorb heat and humidity. This places contraction stress on the bricks and mortar, encouraging bulging or unloading.The location of the expansion joint need to replace the mortor with the joint sealand that materials will reduced the forces that will efect to damage the cocrete.

What Is Stone Masonry Uses And Types Of Stone Masonry

How To Calculate The Masonry Work For Bricks And Blocks

Road Expansion Joints

Road Expansion Joints Generally, expansion joints aren’t handed in the railroad tracks, but if the track is laid on the ground having an expansion joint, furnishing an expansion joint in the track becomes obligatory to alleviate the expansion in the base concrete structure.

Difference B/w Flexible and Rigid Pavement

Difference b/w Camber And Super elevation And Types Of Camber Roads

Calculate The Formwork For Columns Beam Girder And Slab

Pipe Expansion Joints

Pipe expansion joints are necessary for systems that convey high-temperature substances similar to brume or exhaust feasts, or to absorb movement and vibration. Grounded on the type of material used in the timber of the joint.

Types According to Uses Materials

Expansion joints are further classified into the following types, R

Rubber expansion joint

Fabric expansion joint

Essence expansion joint

Toroidal expansion joint

Gimbal expansion joint

Universal expansion joint

In-line expansion joint

Refractory lined expansion joint

Use of padding material in the expansion joint.

How To Install The Expansion Joint

The depth of an expansion joint is generally one-fourth of the arbor/Slab consistency, or further if necessary. The Expansion joint area or gap depends on per type of slab column beam paving, foundation gaps between paving, or any wall joint gaps. It’s also told by the arbor/slab confines, the type of concrete, and the buttressing accouterments being used.

Possible Reason For Crack on Expansion Joints

Cracks in concrete may do at the expansion joints due to improper concrete blend or curing. These conditions beget loss between the expansion joints and cracks can be formed. The basic two times or way to install the expansion joints is below mentioned.

What are The causes of building cracks

Calculate The Numbers of Items for The Stair Case

Installation Before Concrete

When the preparation for Concrete pouring that time prepare the joints of concrete on the location like paving, cross beam, joints between column and paving, and any wall joints. The expansion is made by putting the flexible materials that help to run the concrete along the joint length.

Transportation Concrete |Importance Type And Method Of Transportation Concrete

What Is The Difference B/T Low And Heigh Strength Concrete

After Concrete Installation

After pouring the concrete and setting time of concrete time is very suitable to make grooves in the poured concrete for installation of the expansion joints.

3 Comments